7 Procedural Documentation and Coding

Revenue cycle processes can be divided into two types as shown in Table 7-1—the processes performed on the front-end and the processes performed on the back-end. Front-end processes are those that typically are performed with patient involvement, whereas back-end processes are performed without the patient’s involvement or presence. The accuracy of patient information and timely completion of front-end processes drives the success of the back-end processes to ultimately achieve revenue optimization.

Table 7-1 The Front-End and Back-End Revenue Cycle Processes

| Front-End Processes | Back-End Processes |

|---|---|

| Appointment scheduling and pre-registration | Claim/statement production |

| Insurance verification and referral management | Payment processing and analysis |

| Check-in | Denials management |

| Patient encounter | Accounts receivable follow-up |

| Test/procedure coordination | |

| Check-out |

Front-End Processes

Appointment Scheduling

Check-In

The receptionist plays an important role in the revenue cycle process by validating the patient’s identity and the previously obtained insurance information, as well as collecting any mandatory copayment. Tasks required at the check-in phase of the revenue cycle include, but are not limited to:

Patient Encounter

CPT Codes

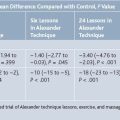

Category II codes, five-digit codes with four numbers and ending with the letter “F”, are intended to facilitate data collection on positive health outcomes and quality patient care. Category III codes, five-digit codes with four numbers but ending with the letter “T”, facilitate data collection on and assessment of, new services and procedures and are used to report procedures that do not have a Category I code. Payors require a valid Category I and/or Category III code(s) for payment consideration. The various types of CPT codes are listed in Table 7-2 with a notation of the application to the pain management specialty.

Table 7-2 Types of CPT Codes∗ and Application to Pain Management

| Category I CPT Codes | ||

|---|---|---|

| CPT Code Number | Type of CPT Code | Application for Pain Management |

| 00100-01999, 99100-99140 | Anesthesiology | Codes describe administration of anesthesia during procedures (generally surgery CPT codes) performed by another provider/physician |

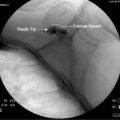

| 10021-69990 | Surgery | Includes codes for injections, placement of pain pumps, and other pain management diagnostic and therapeutic services |

| 70010-79999 | Radiology (including nuclear medicine and diagnostic ultrasound) | Includes fluoroscopic guidance and localization of needle or catheter tip for pain management procedures as well as diagnostic radiologic procedures |

| 80047-89356 | Pathology and laboratory | These codes are generally not used by pain management providers |

| 90281-99199, 99500-99607 | Medicine (except anesthesiology) | Includes nerve conduction and electromyography diagnostic testing codes |

| 99201-99499 | Evaluation and management | Includes codes for office visits, consultations, and hospital visits used by pain management providers |

| Category II CPT Codes | ||

| 0001F-7025F | These codes are supplemental tracking codes that can be used for performance management. They are intended to facilitate data collection about quality of care rendered; the use of these codes is optional. | Includes codes for oncologic pain management as well as assessment and examination of back pain |

| Category III CPT Codes | ||

| 0016T-0196T | These codes are used to report temporary codes for emerging technology, services, and procedures and are used instead of an unlisted Category I CPT code (e.g., 64999). | Includes code for percutaneous intradiscal annuloplasty |

Test/Procedure Coordination

Check-Out

Additional duties performed at check-out include, but are not limited to:

Back-End Processes

Claim and Statement Production

Table 7-3 includes seven very important tips for successful claim submission. The goal is to submit only once a “clean” claim, meaning one without errors or omissions, and be paid in a timely manner.

Practices typically send third party payor claims to a clearinghouse for review, or “scrubbing”, to ensure the demographic, insurance, and code information is appropriate prior to the claim being sent to the insurance company. The edit report, or list of errors noted on the submitted claim, received by the practice must be rectified on a daily basis.

Payment Processing and Analysis

Payments from third party payors and patients come to the practice in various ways including: